Sellers in established communities have several buyers lining up for properties

The buyer is still king in the Dubai property market. However, this rings true mostly for properties in up-and-coming communities, where sellers are having to lower asking prices to meet the expectations of buyers.

During the early part of 2016, several sellers had to accept offers below the property’s marketing price as the gap widened between what they were demanding and how much prospective buyers were willing to pay. However, established prime communities bucked this trend, with multiple buyers lining up with offers.

In instances where a property is in an attractive location, near local amenities and facilities, it has attracted the interest of multiple buyers, resulting in the offers being increased to secure the home.

“Villas within specific communities such as Arabian Ranches, Emirates Living, Victory Heights and The Villa project have experienced slight increases in the actual sale-agreed prices over the latter part of the year. Certain sub-communities, however, still need to reduce their marketing price to attract buyers for viewings,” Nick Grassick, managing director of PH Real Estate, told Khaleej Times.

The property agency cites a specific instance in the first week of December where an Arabian Ranches home sold for Dh50,000 above the marketing price because the buyer did not want to lose the villa to another.

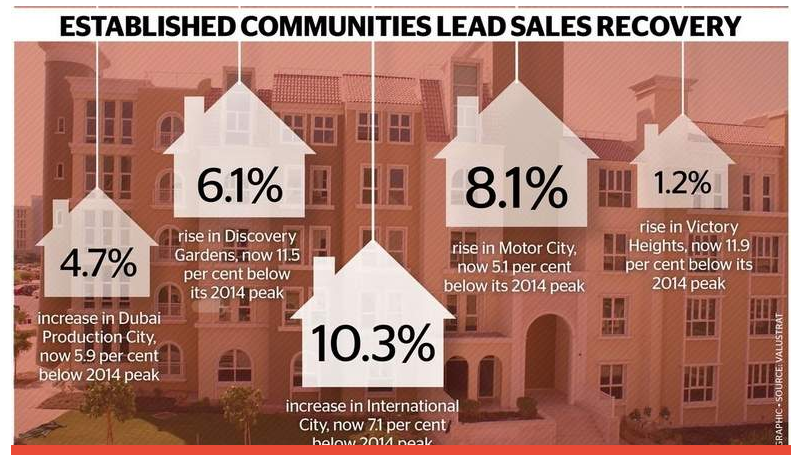

In the apartment market, locations that witnessed price appreciation during 2016 were International City (up 10.3 per cent), Motor City (up 8.1 per cent), Discovery Gardens (up 6.1 per cent) and Dubai Production City (formerly IMPZ) (up 4.7 per cent), according to consultancy ValuStrat.

Soft recovery

“The above locations are expected to continue a soft recovery process towards their 2014 peaks during 2017. Other freehold locations are expected to see prices either remain flat or to initiate a soft recovery sometime during the second half of 2017,” said Haider Tuaima, research manager, ValuStrat.

Well-maintained homes in communities such as Dubai Marina, Downtown, Dubai Sports City and the Palm Jumeirah have also evinced interest from multiple buyers during the latter part of the year.

“Apartments in good condition, which are refurbished, enjoy a pleasant view within a desirable sub-community, not near construction or civil infrastructure works, are much more desirable for buyers,” added Grassick.

Meanwhile, in the leasing market, tenants are reluctant to pay the advertised rent across all locations.

“We think there was a fair correction in rents in 2016, especially in high-end residential real estate. Things look stabilised now and there is not much supply that is likely to hit the market in the high-end residential space. Budget housing has enjoyed continued strong demand throughout 2016. Rents in this segment will possibly go up by two to three per cent through 2017, despite good supply coming into the market,” explained Sanjay Chimnani, managing director, Raine & Horne Dubai.

Rents hit a plateau

There is general consensus in the market that Dubai rents have plateaued after year-on-year gains.

“In terms of rents, we may find 2017 being broadly flat – with Downtown Dubai, Jumeirah Beach Residence and the Palm Jumeirah possibly seeing slight upticks as they regain some recent declines. Slightly lower rents are expected in Dubai Sports City, Dubai Silicon Oasis and International City. Other freehold areas are expected to see rents remain stable during 2017. We expect the bulk of supply to be delivered in mid-affordable areas,” observed ValuStrat’s Tuaima.

Rents are not likely to increase in 2017, with some areas continuing to see the contraction in values seen during the last quarter of 2016.

“Tenants are aware that the money they pay is for a temporary home. As such, there is no appetite to pay a premium for what is likely to be a short- [to at best] medium-term home,” concluded Grassick.

All rights reserved to the initial publisher for lighter side of Khaleej Times.

Collected and published by Arms &McGregor International Realty® editorial team. Get in touched with us at [email protected]