Buying a property in the UAE can be a challenge, especially if you are a tenant that is struggling with accumulating the necessary funds while paying rent.

However, many developers are making it increasingly easy to invest in property in Dubai, by launching several payment options that will allow tenants to pay after moving in.

One of the most popular developers with such an offering is Danube Properties. The developer recently announced that it has sold 75 per cent of its Bayz development, due in part to its benchmark one per cent monthly payment scheme for families with an average household income of Dh15,000-Dh20,000.

“We strongly believe that why should you rent, when you can own a property in an emerging market like the UAE,” says Rizwan Sajan, founder and chairman of Danube Group. “We are one of the first private developers to offer affordable housing combined with a special payment plan of one per cent per month. We have one of the most attractive payment plans for long-term investors and end-users, wherein the buyer just pays a 10 per cent down payment, followed by 15 per cent in 60 days. The balance amount is to be paid in 75 equal monthly installments of only one per cent each month without interest.”

The most attractive part of the payment plan is that it requires buyers to pay only 52 per cent until handover, and the balance in a four year period after handover.

“The aim is to help the mid-income group to realise that their dream of owning a home in the UAE through an affordable payment plan without comprising on quality is very much possible,” Sajan pointed out.

Sailesh Jatania, CEO of Gemini Property Developers, also spoke about the importance of easing the financial strain on tenants interested in buying.

“We believe in flexibility when it comes payment options,” Jatania said. “We know that there are people out there that can take bank loans for 20 years, but end up prepaying the amount in around five years. So, the question is, why take a bank loan if you can go for developer finance. We have found that such options are becoming increasingly popular with buyers.”

The developer’s Splendor at MBR City project is an eight storey luxury residential building with 134 apartments, set to be completed in January 2018; with handover scheduled to start in the first quarter of 2018. Buyers can move in after a 50 per cent payment, and have as many as seven easy installment options to choose from regarding the remaining balance. For example, buyers can pay the remaining 50 per cent over a period of two, three, or five years. Gemini’s one-bedroom units start at a price of around Dh1.1 million, and two-bedroom homes start at Dh1.8 million

“More than 50 per cent of the units have been sold at Splendor, and we are hoping to close the project sales very soon,” he said. The developer also has plans for another development in Dubai’s Business Bay. Asked if the developer would offer the same payment plan for the new development, Jatania said that “there was a possibility.”

Addressing some of the concerns that developers might have with offering such after handover payment options, Jatania noted that developers might have problems collecting the payment especially if the buyers are in countries outside the UAE such as India. Gemini itself prefers to sell to buyers with UAE bank accounts. Splendor at MBR City was clearly envisioned with tenants that have long-term plans of living in the UAE in mind.

Another development that is creating waves with its attractive after handover payment options is Al Haseen Residences in DIP, which is adjacent to Dubai South and minutes away from Al Maktoum International Airport, the Expo 2020 site, and Dubai Parks & Resorts. The project is a G+6, with 132 apartments ranging from studios to one and two-bedroom apartments. Handover in slated for December 2018.

Assad Khan, co-founder and director of City Properties, said: “We have been in the market as a property manager for over 20 years. This is our very first development. Our time as a property manager has given us great insights into the sensitivity of tenants when it comes to buying property. Their thinking is that they are paying rent, but that they are not getting any benefit out of it. In other markets around the world, you rent to own. We wanted to tap into that segment of potential buyers; so this is why we designed our 10 year payment plan.”

The developer has a payment plan that allows for a 30 per cent payment during construction, 10 per cent on handover, and the remaining 60 per cent over 10 years.

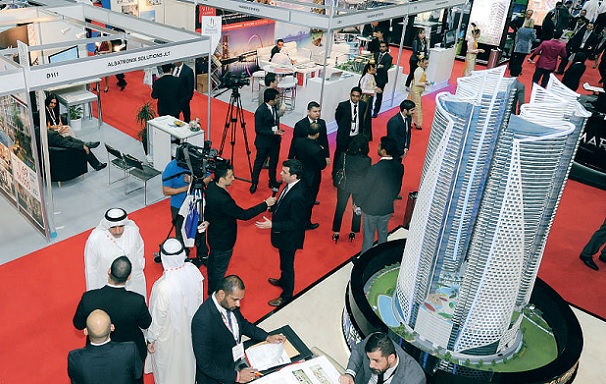

“Our strategy is to fit this into your budget,” Khan said. “The payment plan was designed specifically for Cityscape, but we have plans to extend the offering for a while afterwards as well. The response has been very favourable.”

All rights reserved to the initial publisher for Khaleej Times.

Collected and published by Arms &McGregor International Realty® editorial team. Get in touched with us at [email protected]